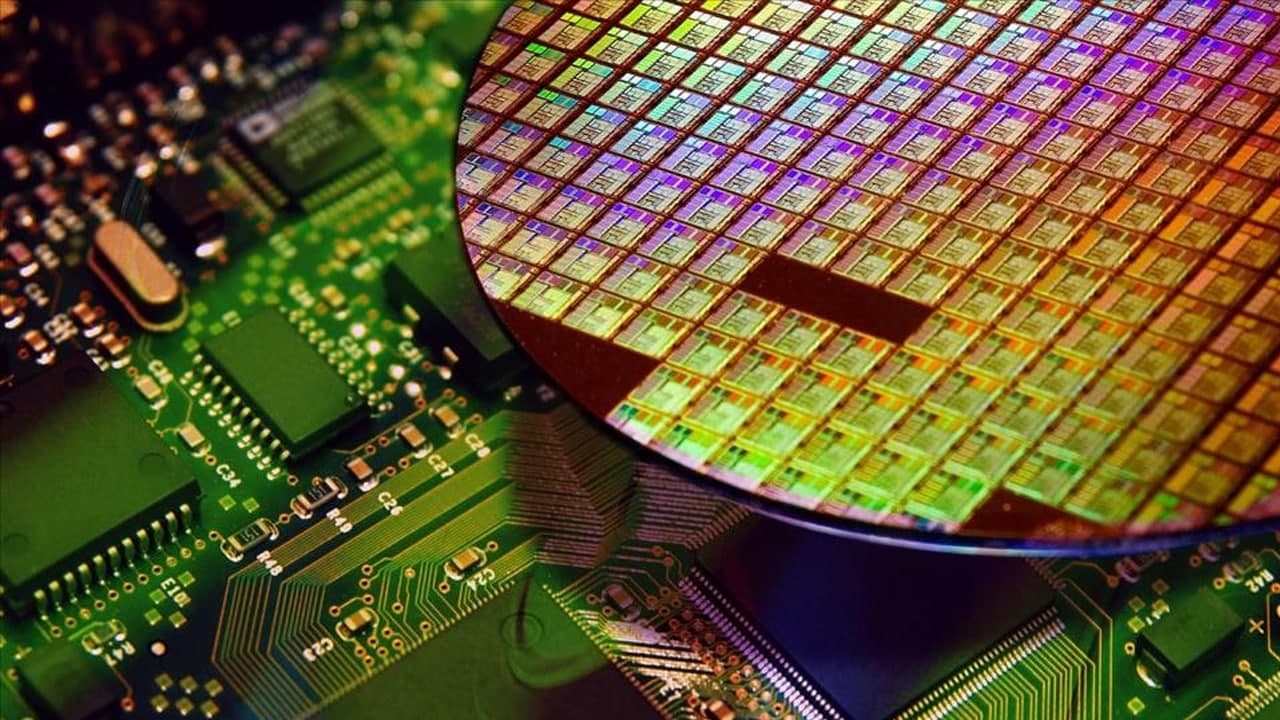

Two Ukrainian suppliers, which account for about half of global semiconductor-grade neon gas production, have ceased operations as Russia ramps up its attack on Ukraine, which could lead to higher chip prices and a shortage of semiconductors. Neon gas is an important raw material for chip production.

According to data provided by market research firm Techcet and Ukraine’s two major neon gas suppliers, Ingas and Cryoin, 45% to 54% of the world’s semiconductor-grade neon gas comes from Ingas and Cryoin. Techcet estimates that global consumption of neon gas for chip production last year was about 540 tons. Neon gas is essential for the lasers used in chip production.

Join Tip3x on Telegram

Two major suppliers stop production

Representatives for Ingas and Cryoin said both companies had closed their operations due to the destruction of critical infrastructure due to the fighting. Their shutdown has cast a shadow over global chip production.

Moreover, chips are already in short supply after the coronavirus pandemic boosted demand for phones, laptops, and later cars, forcing some companies to cut production.

While industry estimates for existing neon inventories by chipmakers vary widely, production could be more likely if the conflict persists, said Angelo Zino, an analyst at the Center for Financial Research and Analysis (CFRA), a research consultancy.

“If inventories are depleted by April and chipmakers don’t lock down orders in other parts of the world, it will likely mean that the wider supply chain will be further constrained from producing final products for many key customers,” he said.

Before the Russian attack, Ingas was producing 15,000 to 2 per month for customers in Taiwan, China, South Korea, the United States, and Germany, Nikolay Avdzhy, Ingas’ chief commercial officer, said in an email. About 75% of the 10,000 cubic meters of neon gas goes to the chip industry.

Cryoin, located in Odessa, produces approximately 10,000 to 15,000 cubic meters of neon gas per month. Cryoin halted operations to protect the safety of its employees on Feb 24 when Russia launched an attack, according to Larissa Bondarenko, Cryoin’s director of business development.

Bondarenko said the company would not be able to fulfill its 13,000 cubic meters of neon gas orders in March unless the violence stopped. With factories closed, the company can survive at least three months, she said.

But she warned that if the equipment was damaged, it would be a bigger drag on the company’s finances, making it harder to restart operations quickly. She also said it was uncertain whether the company would be able to obtain the additional raw materials needed to produce neon gas.

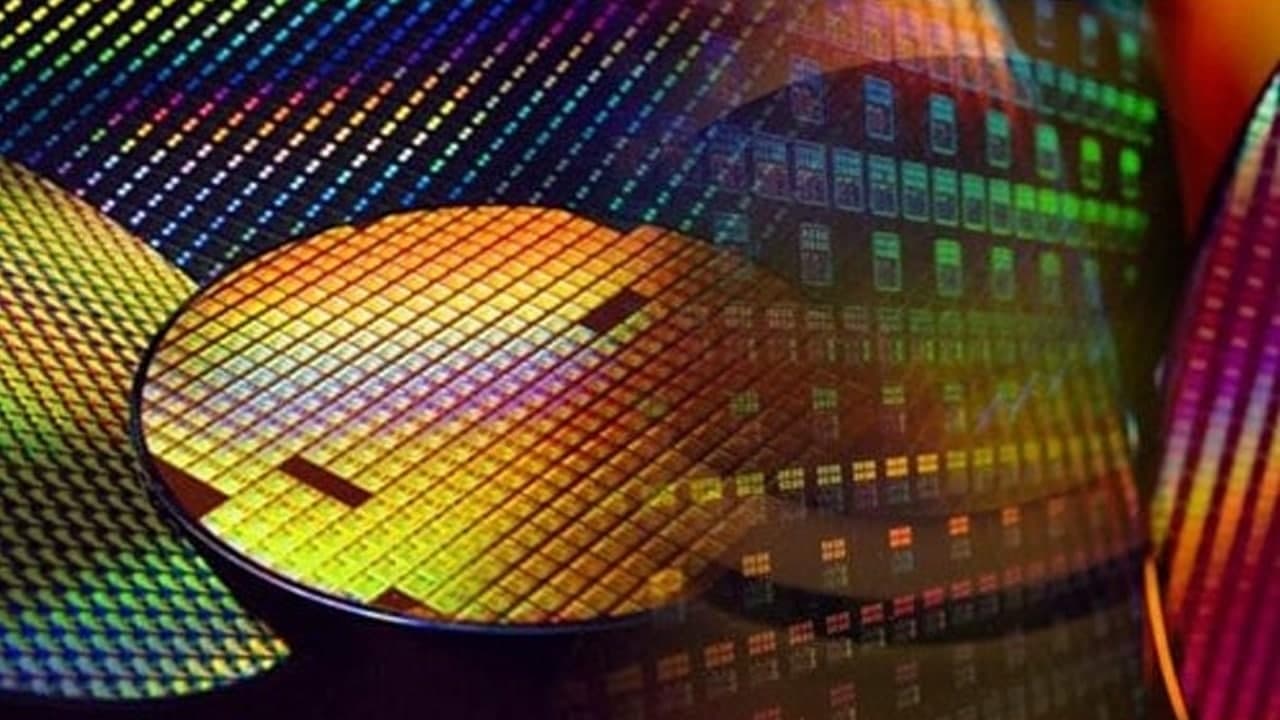

Prices soared

Bondarenko revealed that neon gas has come under pressure to increase prices in the wake of the Covid-19 pandemic, with prices now up 500 percent from December last year.

Chinese commodity market information provider biiinfo reported that the price of neon gas (99.9% purity) in China has quadrupled from 400 yuan per cubic meter in October last year to more than 1,600 yuan per cubic meter at the end of February this year.

The price of neon gas rose 600 percent before 2014, according to the U.S. International Trade Commission.

Companies elsewhere may start neon production, but it will take nine months to two years to ramp up capacity, said Richard Barnett, chief marketing officer at Supplyframe, a market intelligence firm for the global electronics industry.

However, CFRA analyst Zeno noted that companies may be reluctant to invest in the process if the supply crunch is seen as temporary.