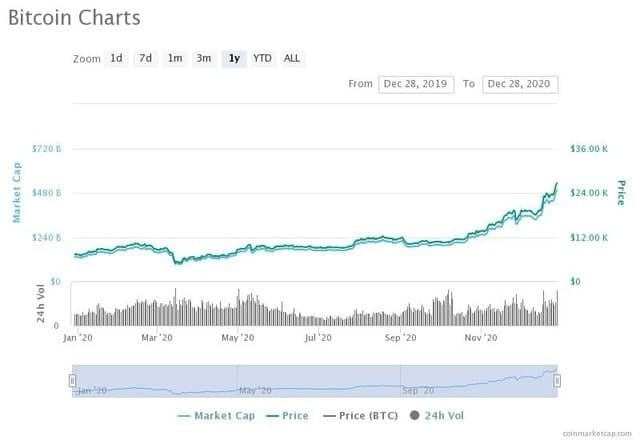

As of the publication of this article, Bitcoin has surpassed $28,000, which is one step closer to the integer mark of $30,000. Although Bitcoin has been born for more than ten years, there are not many players who can actually access Bitcoin.

Many people can’t help asking, what is it that this year’s epidemic has caused such a downturn in the global economy?

In fact, the answer to this question is already in the question. A senior analyst at a research institute analyzed the “International Finance News” reporter and pointed out that this round of rising maybe because the epidemic has once again intensified expectations of global economic recession.

Global inflation has become an unstoppable trend, and deflationary assets with anti-inflation properties were originally It is a scarce resource, and the demand for Bitcoin has further increased.

In addition, the market’s expectations for Bitcoin-compliant products have further increased, and many licensed investment institutions have established digital currency funds or applied to regulators to trade digital currencies, which has helped to boost the price of Bitcoin.

On the whole, the apparent reason for the main push of Bitcoin’s skyrocketing must be due to short supply, but why the supply exceeds supply is the key to the problem.

As the analyst said, it is precise because the epidemic has caused the global economic downturn, so people invest in Bitcoin is a kind of “safe-haven” demand.

There was an old saying in the past called “Prosperity antiques, troubled times gold”. In fact, when the economy is not good, people will buy gold to seek the preservation of their assets. With Bitcoin, they have more choices.

Regarding the question of whether Bitcoin has such a profound value, we do not need to discuss it again. The key is that the mechanism of Bitcoin makes it more attractive than traditional gold.

First of all, Bitcoin has a fixed amount, so there is no problem of inflation caused by spamming money. Secondly, Bitcoin can be more “free” transactions and has the characteristics of privacy or anonymity.

Although many countries currently do not recognize Bitcoin, and there have been many dark sides surrounding Bitcoin, the charm of Bitcoin has attracted the attention of more and more institutions and capital around the world, as long as there are huge profits.

Therefore, the industry has also begun to generally expect that Bitcoin will gradually “turn positive” in the future. The more funds injected, the higher the value of a single currency.

The so-called “Bitcoin compliance” expectations of experts can actually be used as an analogy. An underground singer has become so famous that he stepped onto the front desk and entered the mainstream media and the crowd.

But after “turning to normal”, it is obvious that I can no longer sing the old words of the past, and that thing is neither legal nor on the stage. Bitcoin turns positive, which is a relatively good expectation at present.

To describe it in professional terms, “the global digital asset trading field will be mainstreamed, compliant, and institutionalized. This is an irreversible trend.

However, the skyrocketing price of Bitcoin seems to be beaming, and everyone knows that the moment when the Bitcoin site reached $28,000, the entire network broke out 3.4 billion.

Because in addition to being long, bitcoin trading venues allow leverage to be short. Some time ago, you might have read the news about “Husband and Wife committing suicide after losing 20 million in Bitcoin”. I urge you to be cautious and be cautious!

Every time the price of Bitcoin skyrocketed, people started all kinds of lustful fantasies about digital currency or blockchain, and the whole thing was the same.

And in those years when Bitcoin was lying on the ground, who cared about what it was? More Do not take it something to do with the relationship between the central bank’s digital currency, really it is not half dime, okay!

Bitcoin has been born for more than ten years, and it has long been nothing new. In fact, there have been no leaks in the currency circle for a long time, and the rest are gamblers. Everyone knows that they know each other and smile.